In today’s fast-paced and dynamic business environment, organizations are faced with numerous risks that could impact their growth and success. These risks span across a wide range of areas, including financial, operational, regulatory, and strategic. To navigate these challenges effectively, companies need robust systems in place to manage and mitigate risks. This is where Enterprise Risk Management (ERM) software comes into play.

ERM in risk management has evolved into a strategic tool that helps businesses identify, assess, and manage potential risks, ensuring that they are well-prepared to handle any uncertainties. By integrating risk management processes into every facet of the business, ERM software enables organizations to proactively address threats while capitalizing on opportunities. This blog explores how ERM software can enhance enterprise risk management processes, providing businesses with the tools they need to thrive in today’s complex business landscape.

1. Comprehensive Risk Identification

One of the primary functions of an ERM system is risk identification. ERM software provides businesses with a centralized platform to identify and categorize potential risks from various sources, whether they are internal or external. These risks can include operational disruptions, financial instability, market volatility, or cyber threats, among others.

By using enterprise risk management tools, organizations can conduct risk assessments across departments, ensuring that no potential threat is overlooked. With the ability to gather data from multiple sources, ERM systems allow businesses to pinpoint risks early, giving them the opportunity to mitigate them before they escalate into more significant problems.

2. Risk Assessment and Prioritization

Once risks have been identified, the next step in the process is assessing their potential impact and likelihood. Enterprise risk management software facilitates this process by providing sophisticated tools for risk evaluation. With features such as probability and impact scoring, businesses can prioritize risks based on their severity and potential consequences.

ERM systems enable businesses to assess risks in real-time, considering both the short-term and long-term effects. By using automated scoring models and risk heatmaps, ERM software helps organizations determine which risks require immediate attention and which ones can be monitored over time. This prioritization ensures that resources are allocated efficiently to manage the most pressing risks first.

3. Streamlined Risk Mitigation Strategies

A major advantage of using enterprise risk management solutions is the ability to develop and implement mitigation strategies more effectively. Once risks are assessed and prioritized, ERM software provides businesses with the tools to create action plans tailored to reduce or eliminate these risks.

The software allows organizations to assign tasks and track progress on risk mitigation efforts, ensuring that strategies are executed on time and within budget. With automated reminders and task management features, businesses can ensure that mitigation measures are implemented consistently and comprehensively, preventing potential risks from materializing into significant issues.

4. Improved Decision-Making and Strategic Planning

ERM in risk management is not just about reacting to threats but also about enabling proactive decision-making. With the insights gained from enterprise risk management software, businesses can make informed, data-driven decisions that align with their risk tolerance and long-term goals. The system provides a comprehensive view of the organization’s risk profile, which is crucial for strategic planning.

With ERM software, executives and managers can evaluate different scenarios and their associated risks, helping them make better decisions about investments, resource allocation, and growth initiatives. This strategic perspective ensures that businesses are not only protected from risks but also positioned for sustainable growth.

5. Real-Time Monitoring and Reporting

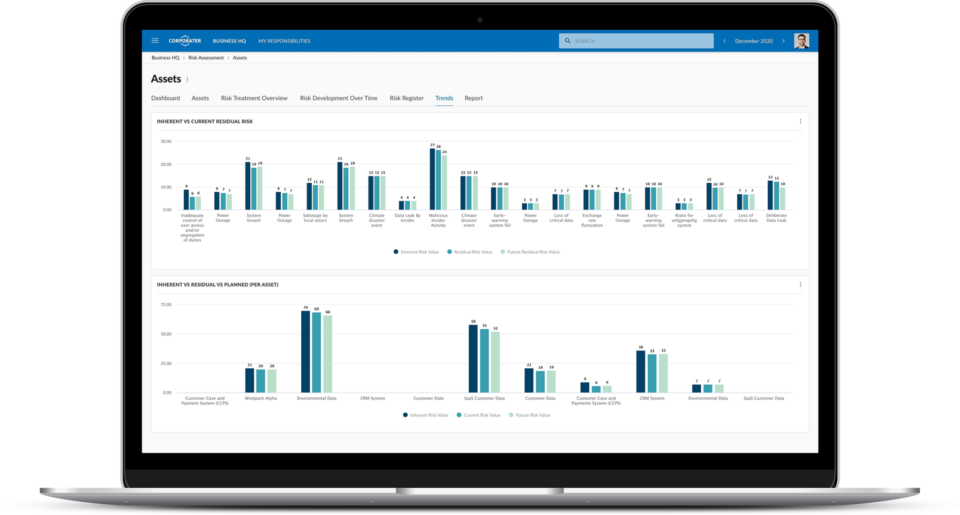

Another significant benefit of enterprise risk management tools is the ability to monitor and report risks in real time. ERM software provides continuous monitoring of risk exposure, allowing businesses to detect changes in risk levels as they occur. This real-time capability enables organizations to respond quickly to emerging threats or opportunities.

Additionally, ERM software offers customizable dashboards and automated reports that keep key stakeholders informed about the current risk landscape. With detailed risk reports, businesses can maintain transparency and ensure that risk management activities are aligned with organizational objectives.

6. Compliance and Regulatory Adherence

With the ever-changing landscape of regulations, businesses must stay compliant with industry standards and legal requirements. Enterprise risk management software helps businesses stay on top of compliance by tracking regulatory changes and ensuring that risk management processes meet legal and industry-specific standards.

By integrating compliance requirements into the risk management framework, ERM systems ensure that organizations are prepared for audits and regulatory reviews. This helps businesses avoid fines, penalties, and reputational damage associated with non-compliance.

In an era of growing uncertainty and complex business environments, ERM software is an essential tool for organizations seeking to manage risks more efficiently. By offering comprehensive risk identification, assessment, and mitigation features, enterprise risk management solutions provide businesses with the insights they need to stay competitive and secure.

With the right ERM system, organizations can streamline their risk management processes, make better-informed decisions, and enhance their resilience to unforeseen challenges. The ultimate goal is to safeguard the organization’s assets, reputation, and long-term success. Investing in enterprise risk management tools will equip businesses to not only survive but thrive in a world full of risks.